First Home Buyer Rules Overhauled: Major Changes Arrive Early

Australia’s housing market is about to undergo its most significant shift for first-time buyers in decades – and it’s happening ahead of schedule. From 1 October 2025 (brought forward by three months), the Federal Government will introduce the expanded First Home Guarantee, designed to open the door for thousands who have struggled to get a foothold in the market.

Key Changes at a Glance

The reforms are aimed at removing long-standing barriers that prevented many Australians from buying their first property.

- What’s gone: Income thresholds, postcode restrictions, and outdated price caps

- What’s new: Broad access for all eligible first-home buyers with a 5% deposit

In effect, the scheme allows purchasers to avoid costly Lenders Mortgage Insurance (LMI), cutting upfront expenses by tens of thousands of dollars.

Updated Price Caps (Effective October 1st)

- Brisbane: $700,000 → $1,000,000

Potential Savings

- $500,000 home: approx. $15,000 saved in LMI

- $1 million home: approx. $41,000 saved in LMI

- Deposit timeframe: reduced from 7–10 years down to 2–3 years

Why It Matters

✅ Accelerated market entry – fewer years of saving required

✅ Reduced upfront costs – no LMI premiums to pay

✅ Greater choice – higher thresholds reflect real market values

But buyers should remain mindful:

⚠️ Increased competition is expected as more people qualify. With income caps removed, many more Higher-income earners will qualify

Interest Rate Tailwind

Interest Rate Tailwind

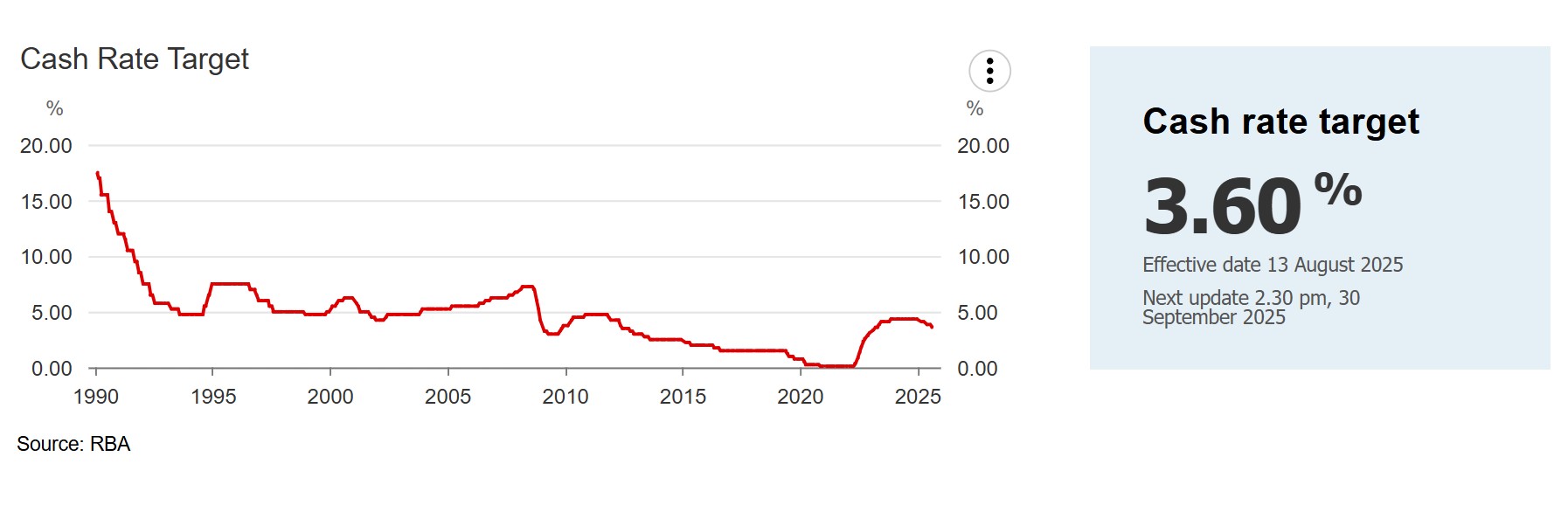

The changes also align with favourable monetary policy. In August 2025, the Reserve Bank of Australia lowered the cash rate to 3.6%, the third reduction this year. For buyers, cheaper credit combined with government backing may create a rare window of opportunity. For sellers, this points to more active buyers and faster sales cycles.

Preparing for October 1st

To make the most of the scheme, potential buyers should:

- Assess borrowing power under current interest rates

- Identify target suburbs within the revised price caps

- Secure financial pre-approval

- Budget for additional costs such as stamp duty, legal fees, and moving expenses

Strategic Approaches

- Focus on emerging areas within the price thresholds that may see future growth

- Weigh up regional markets, where value often stretches further

- Remain cautious – a higher cap doesn’t mean stretching finances to the limit

- Remember ongoing ownership costs, from strata fees to maintenance and rates

Final Word

This reform marks the most substantial support for first home buyers in a generation. It won’t solve affordability overnight, but it will dramatically lower the entry barriers for thousands.

With more than 20,000 additional buyers expected each year, competition is inevitable which will in turn push the property prices further. For those ready to act, October 1st could be the turning point – but success will depend on preparation, financial discipline, and timing.

👉 If property ownership is your goal, now is the time to sharpen your strategy and get market-ready, especially the rollout coincides with the spring property rush.